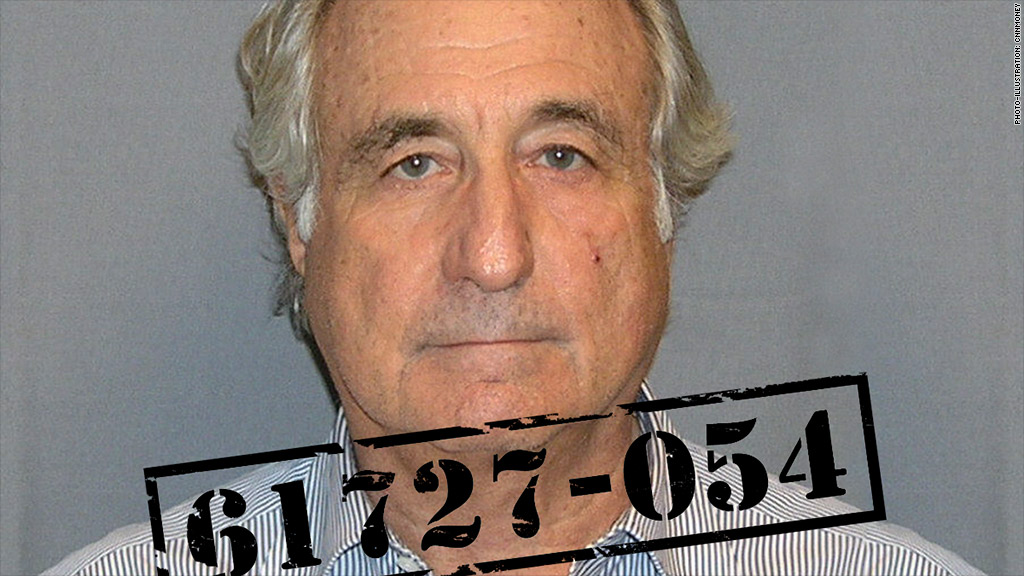

The question is, of course, “How did he manage to get away with it for so long?”

What was his secret?

Here’s Madoff himself, offering us clues:

“[Prospective investors] were all told by me, ‘Don’t invest any more money than you could afford to lose. This is the stock market. There’s always stuff that can happen. Brokerage firms can fail. I could go crazy and do something stupid. If you want a [safe thing], put your money in government bonds. So everybody understood this… Everyone was greedy. I just went along. It’s not an excuse… Look, there was complicity, in my view.”

And besides that, Madoff had a huge firewall. He split off the “Investment Advisory” division of his business, where the fraud was actually perpetrated. This activity was located on the 17th floor, in a locked office space. According to the film, only one other employee was privy to what actually what took place on that floor. Most of the staffers in this division were high school graduates without securities licenses or training. They included a former waitress, a former construction worker, and a former keypunch operator. And, there were only about a dozen of them! Far too small a number to be managing billions of dollars worth of accounts. But even with such a small staff, they later testified that they frequently had no work to do. They would put their feet up on their desks and watch television.

1988 computer running 65-billion-dollar scam until 2009

1988 computer running 65-billion-dollar scam until 2009 Okay… wildly unrealistic investment returns that consistently out-performed other financial investment companies, weirdly outdated modes of communication with clients, and a bizarre culture of secrecy around the locked office on the 17th floor.

Again, “How did he manage to get away with it for so long?”

Madoff victims Kevin Bacon, Zsa Zsa Gabor, Elie Weisel

Madoff victims Kevin Bacon, Zsa Zsa Gabor, Elie Weisel They trusted him, because he made a point of gaining their trust. He deployed the six strategies for gaining trust that are identified by social psychologist Robert Cialdini:

1) Reciprocation. People feel indebted to those who do something for them or give them a gift. Madoff was paying his clients higher returns than they could get anywhere else, and they were grateful. Madoff also paid out a ton of bonuses to people who worked for him at all levels.

2) Social Proof. When people are uncertain, they want to know what everyone else is doing—especially their peers. Who was investing with Madoff? Steven Spielberg, Larry King, Sandy Koufax, Elie Wiesel, John Malkovich… banks, university, and charities… lots of charities. (Hint: They tend not to withdraw money for long periods of time… a plus with a Ponzi scheme.)

3) Commitment and Consistency. People do not like to back out of deals. Madoff was following through with consistent high returns. His clients were consistent and committed, too.

5) Authority. People respect authority. They follow the experts. Madoff was the former chairman of NASDAQ, the second largest exchange in the world. And, of course, he was a billionaire with all the trappings: the homes, the cars, the clothes.

6) Scarcity. The more rare a thing, the more people want it. Madoff created an aura of exclusivity about clients. He made investors compete for limited slots in his imaginary funds, and then he used this competition to leverage the size of the investments.

Summing up: Why didn’t people see what was going on?

They trusted Madoff. He manipulated that trust.

iSlave factory?

iSlave factory? But what if there is another Ponzi-type scam going on in this country—one that is so huge, nobody can even see it? What might that 17th floor look like?

Well… I think it would be full of environmental pollution from Trump’s deregulation and gutting of the EPA. It’s expensive to comply with regulations, which is one of the reasons why the stock market soared the day of his election. But… like a Ponzi scheme, deregulation is going to have a day of reckoning... especially when it results in the gutting of natural resources and quality of life. Short-sighted isn't even the word...

The 17th floor is also filled with slaves and people working at slave wages in the countries where so much of our manufacturing is being outsourced. Again, higher profits for us… but at what cost? Neocolonialism is going to work about as well as colonialism, and at the end of the day, it will collapse like a Ponzi scheme.

What else is on our 17th floor? Weaponry. Tons and tons of it… much of it obsolete even before it’s finished. But who cares? The military is the single largest contractor in the US, and nearly every corporation makes big bank off selling to them. But to keep that party going, we need to be perpetually at war… which we have been for decades now. But as we continue to generate demand for military goods in these manufactured wars, we are also growing our enemies, and they are forming ever-more-powerful alliances, often fighting us with weapons we built! Again, how sustainable? As with a Ponzi scheme, the balloon payment is going to be a real killer.

But still we trust. We don’t ask questions. We don’t go up on the 17th floor.

We trust, because investments are still turning profits. We trust because everyone else is trusting. People with even modest savings are investing. We believe in our country. We have a commitment. We like our bankers, our advisors. They are nice people. They have authority. And we believe we are lucky to have this economy. There is so much scarcity everywhere else. We, like Madoff, are in too deep to even consider ways of getting out. And our trust, like the trust of Madoff’s clients, is carefully cultivated and manipulated.

Ken Lagone was onto him.

Ken Lagone was onto him. "He said something I found repulsive. He said to us, 'By the way, this fund I'm starting is going to be better than (the ones for) my existing investors.' That turned me off," Langone said.

Langone was not blinded by prospects of above-market returns and not seduced by seemingly preferential treatment by a Wall Street mogul. Langone, identifying with the interests of others, was, apparently, the exception. Most of Madoff’s clients would fall for his pitches. (Yes, it's too bad Lagone cannot extend that kind of identifying to gays and lesbians.)

But That little vignette with Lagone is the key: Identify with others. Who is being thrown under the bus for corporate profits? Are we honestly believing that, when the crunch comes, we will not also be considered expendable?

"The whole government is a Ponzi scheme." -- Bernie Madoff.

RSS Feed

RSS Feed